The thinking goes that start-ups are so inherently uncertain that any financial model that aims to predict a company’s future performance is inevitably going to be so “out” that it will be useless.

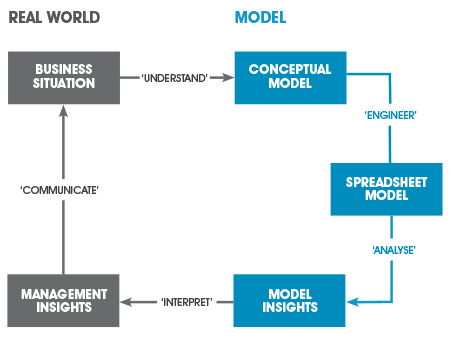

To insure reliable data for the financial model, the authority may require private contractors to submit audited annual financial statements that corroborate its monthly or periodic regulatory and contract compliance reports.There is a school of thought that building a start-up financial model is a waste of time. The model also takes into account the cost and funding sources for bus system infrastructure improvements.Īs the bus system shifts toward greater degrees of private contracting, the financial model relies on the bids submitted by the private bus operators for a significant amount of cost data. A variety of forecasting techniques are then used to project future bus operating and capital costs and the amount of revenues required to fund these costs. Initially, the financial model builder uses existing bus system data to model the “baseline” situation. Construction of such a model is a complex task.

It must reflect the specific characteristics of the bus system and authority requirements. The financial model is a dynamic tool that estimates the bus system’s initial financial position and simulates, on an annual basis, its future financial position. Other financial management information system factors.Government accounting and auditing laws and standards.The nature of the information database that provides cost, revenue and other bus system data inputs.The nature of the bus operations and extent of private operations.There are many different ways to construct a financial model depending on:

System planning, management, regulatory and oversight functions cost money, and must be properly funded to ensure sustainability. The second general objective is to assist the authority to manage the financial operation of the authority itself. The authority can use the financial model to assess the cost and revenue impact, on the bus system’s financial position, of changes to the system design. The first general objective is to assist the authority to improve the financial operation of the bus system. General objectives are discussed below specific objectives are noted on the pages devoted to each reform option. It has general objectives regardless of the reform option chosen, and specific objectives depending on the reform option. The financial model allows the transit authority to perform financial management and assess the effect of changes in key variables affecting the bus system.

0 kommentar(er)

0 kommentar(er)